The Era Of Rothschild’s Unelected Centralization Is Ending Right Before Our Eyes

Politicalvelcraft

The most critical element of the BREXIT is that it is THE closing bell being rung on the period of Centralization from 2009 to today.

What do I meant by Centralization? I am referring to the era of Central Planning of the global economy by Central Banks.

In the US, we’ve seen the Federal Government/ Federal Reserve become involved in virtually every major industry in the economy including insurance, healthcare, housing/mortgages, banking, financial services, and even energy.

The US is not unique in this regard. Japan and the EU have also been in a period of Centralization, with their respective Central Banks becoming increasingly involved in their respective economies.

The BREXIT has ended this.

- Brexit Victory Of Sentient Mankind: Nuremberg For The Mechanistic NWO Money Changers

- Developed Market DEBT Bond Yields Crash To Record Lows: Brexit Was Only The Symptom… Debt Was The Diagnosis

- Central Banks {TPTB} Are Terrified: Nullifying Their Quantitative Enslavement Experiment

- Imminent Arrival Of Rothschild’s Terminal Phase To Their 1913 NWO Totalitarian Experiment: QE To Infinity & Hyperinflation

- France: Entire Swiss Branch Of Rothschild’s Banking Empire Under Criminal Investigation Following David De Rothschild Indictment

In a world of fiat, all major currencies are priced against a basket of their peers. So when one Central Bank engages in a particular policy with the intent of devaluing its currency, that same policy inevitably puts upwards pressure on other currencies.

From 2008-2013, there was a degree of coordination between Central Bank. The best example would be when the Fed launched QE 3 in 2012, coordinating this policy with the ECB’s OMT program. At that time, the economic data in the US was in fact improving and the Fed should have been tightening. QE 3 was as much a gift to the EU as anything.

QE: Quantitative Enslavement

At this point, Centralization began to come apart as Central Banks were now outright damaging each other’s efforts to devalue their currencies. However, it wasn’t until BREXIT that we received a REAL nail in the coffin for Centralization.

Let me explain.

In the world of Central Planning, POLITICS, not economics, drives policy.

Any sensible economist would have realized QE and ZIRP couldn’t generate GDP growth around 2011.

However, in the world of Central Planning, the political implications of admitting this (relinquishing control of the financial system and permitting debt defaults/ restructuring to begin) is akin to political suicide.

Put another way, if Janet Yellen or Mario Draghi were to stage a press conference to state “my life’s work is incorrect, I have no idea how to generate growth, it is time for market forces to take hold and price discovery to occur” not only they but EVERY other Central Banking economist/ academic would soon be unemployed.

For this reason, the end of Centralizaton was only going to come through one of two ways:

1) Politically (if voters finally revolted against the status quo).

2) Financially if market forces became so intense that even the Central Banks lost control of the system.

With Brexit, we’ve already had #1. We’re now on our way to #2.

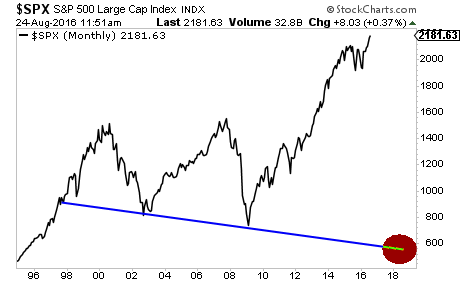

Indeed, we believe that by the time the smoke clears on the next Crisis, the S&P 500 will have fallen to new lows.

S&P 500 August 24, 2016

- The Tech bubble was a stock bubble: a bubble focused on stocks as an asset class:

- The Housing bubble was a real estate bubble: a bubble focused on houses, and even larger, more significant asset class.

- This current bubble is the BOND bubble: a bubble in the senior most asset class in the financial system

- Speculators trading the paper derivative is what is allowed to set price, and that is absolutely breaking everything

With over 30% of global bonds posting negative yields, the financial system is a powder keg ready to blow.

Zero Hedge

Related Articles:

- Hungary Approaches HuExit: October 2nd 2016 Anti-EU Referendum

- Physical Silver & Gold Are Not Reflected By The Current Paper Scam Derivative Price Charts

- There Has NEVER Been a Bigger Fundamental Reason to Own Physical Gold and Silver Than THIS

- Russian Bomber Tupolev-22 Destroying U.S. Israeli Proxy Army ISIS Across Syria: China’s Military Also Arrives To Help President Assad