Central Banks {TPTB} Are Terrified: Nullifying Their Quantitative Enslavement Experiment

PoliticalVelCraft

A quick question for the “recovery” enthusiasts…

If the recovery is real and as

strong as the[ir] “data” suggests… why are [their] Central Banks engaged

in the most aggressive stimulus in history?

Consider Europe:According to the official data, the EU’s Services and Manufacturing PMI’s were 53.1 and 51.8 in August. Both were significantly above 50 (which represents contraction)…

Moreover, the EU’s inflation rate has risen over 0.4% in four months, rising from -0.2% in April to 0.2% today.

And yet, despite this data, the ECB continues to hold interest rates at -0.4% while also spending €80 billion per month in QE (the equivalent of $90 billion). At this pace, the ECB will spend nearly €1 TRILLION IN QE PER YEAR.

Put another way, the ECB is engaged in the most aggressive monetary policy in its history (even more aggressive than at the heart of the 2012 EU banking crisis) at a time when the EU economy, according to official data, is well above contraction.

- Brexit Victory Of Sentient Mankind: Nuremberg For The Mechanistic NWO Money Changers

- Everything Is Awesome Right Before The Entire Economy Collapses: No Problem For Iceland As They Jailed The Bankers & Nullified The Debt.

Then there’s Japan:

According to the official data, the Japanese economy has “bounced back” and avoided recession, posting a growth rate of 0.5% in 1Q16.

Granted, this is not great, but it’s much better than the -0.4% growth rate for 4Q15.

On top of this, while Japan’s August Manufacturing PMI was 49.3 (just below contraction levels) it has been rising for the last three months from the low of sub-48 back in May. That same month Services PMI broke above contraction levels to 50.4.

Despite this, the Bank of Japan maintains interest rates at -0.1% and is currently spending nearly $800 billion per year buying assets. Astoundingly, the BoJ is actually buying all of Japan’s new Government debt issuance per year.

It is also a top 5 shareholder for 81 of the 225 companies trading on the Nikkei 225. And it owns 60% of the Japan’s ETFs.

Put another way, like the ECB in Europe, the BoJ is engaged in the single most aggressive monetary policy in its history… at a time when, according to the data, Japan is NOT even in a recession.

Looking at this, it is obvious that something is very wrong. Either the data is inaccurate, or Central Banks know something we don’t.

- A Very Bad Year for {TPTB} Globalism Conspiracy

- 9 Indisputable Facts About Scientific Conspiracy Theorists

After all, they’re behaving as if

they’re absolutely terrified at a time when the data is claiming their

economies aren’t even in contraction!!!

Just what are they scared of?We firmly believe the markets are preparing to enter another Crisis. With over 30% of global bonds posting negative yields, the financial system is a powder keg ready to blow.

The Bond Bubble is THE bubble. And with over $555 trillion in derivatives trading based on bond yields, this bubble is over 10 times the size of the one that nearly took down the system in 2008.

Zero Hedge

Recovery Begins With Admitting

This Fraudulent Debt Must Be Nullified

Iceland Showed The World The Power Of The U.S. 1776 Revolution.Three years after Iceland’s banks collapsed and the country teetered on the brink, its economy is recovering, proof that governments should let failing lenders go bust and protect taxpayers, analysts say.

“The lesson that could be learned from Iceland’s way of handling its crisis is that it is important to shield taxpayers and government finances from bearing the cost of a financial crisis to the extent possible,” Islandsbanki analyst Jon Bjarki Bentsson told AFP.

“Even if our way of dealing with the crisis was not by choice but due to the inability of the government to support the banks back in 2008 due to their size relative to the economy, this has turned out relatively well for us,” Bentsson said.

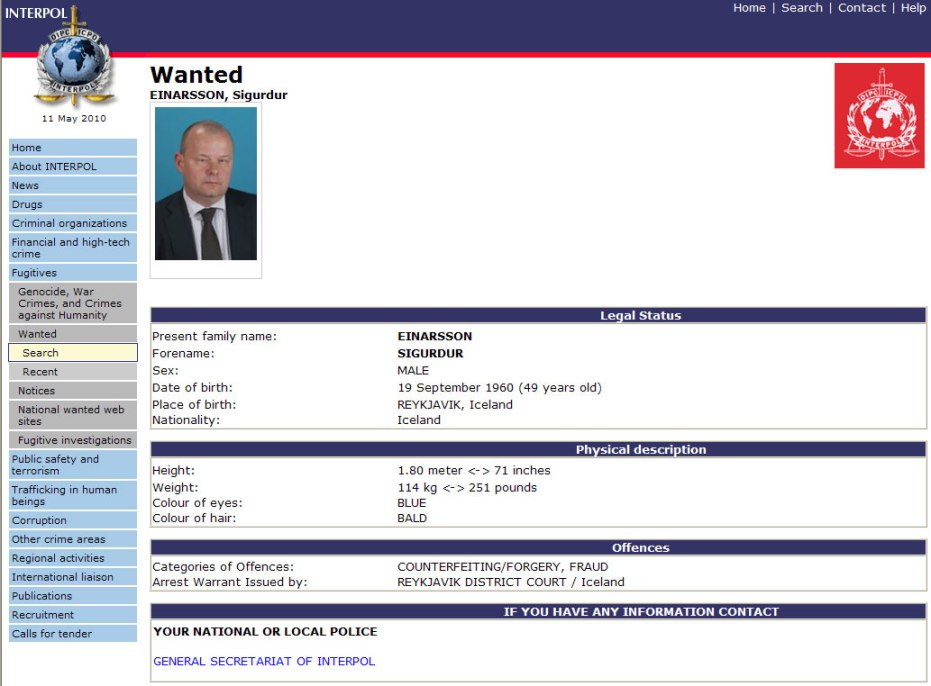

Arrest Warrant Issued By Interpol For Sigurður Einarsson ~ He has now been listed on the website of the international law enforcement agency as “wanted”.

The former banking executive, who lives in West London, publicly blamed Gordon Brown for Kaupthing’s collapse back in October 2008.

Iceland’s

special prosecutor issued an international arrest warrant for Mr

Einarsson yesterday, with a description of him as 1.8m tall, 114kg in

weight, bald and with blue eyes.

Iceland’s

special prosecutor issued an international arrest warrant for Mr

Einarsson yesterday, with a description of him as 1.8m tall, 114kg in

weight, bald and with blue eyes.

- Iceland’s implosion was organized and orchestrated along with The United State’s and other nation state collapses.

- Bankers felt top GDP had been achieved and that it was time to implode the system, while betting against the success of the nation state financial systems.

- This on a smaller scale is known as orchestrated “inside trading” which allowed convicted felon George Soros to loot $Billions of dollars.

- One month earlier than October 2008 this happened.

Iceland’s

special prosecutor issued an international arrest warrant for Mr

Einarsson yesterday, with a description of him as 1.8m tall, 114kg in

weight, bald and with blue eyes.

Iceland’s

special prosecutor issued an international arrest warrant for Mr

Einarsson yesterday, with a description of him as 1.8m tall, 114kg in

weight, bald and with blue eyes.

According to Icelandic media reports, he has told the prosecutor’s

team that he is willing to return to his home country to help with their

enquiries on the condition that he is not arrested on arrival.

His former co-chief executive, Hreidar Mar Sigurdsson, was arrested last week on suspicion of falsifying documents and market manipulation. He is still in police custody.

Kaupthing’s collapse in October 2008 cost the British Treasury £2.5bn

and hundreds of UK savers with its Isle of Man branch are still waiting

to be fully compensated. Both he and Mr Einarsson have previously

denied any wrongdoing over Kaupthing’s collapse.The bank’s actions are under investigation by the UK Serious Fraud Office and a special inquiry team in Iceland over claims of share ramping and big loans to related parties.

Iceland’s special prosecutor is looking into more than 20 cases of potential criminal activity connected to Kaupthing and the country’s other failed banks.

A special report by Iceland’s parliament showed Kaupthing secretly owned almost half of its own shares.

Two-thirds of Kaupthing’s clients were based in London, including high-profile investors such as Robert Tchenguiz, Simon Halabi and the Candy Brothers, who all lost substantial sums in the crash.

After Kaupthing’s loan book was leaked on to the internet last August, it showed key shareholders and owners were the bank’s main borrowers. Mr Tchenguiz, who was a director of Kaupthing’s largest shareholder, had the biggest debt of €1.74bn.

Following the disclosure, Mr Sigurdsson defended the bank’s practices but made a public apology. “Mistakes were made,” he said. “I’m obliged to offer my apologies to the bank’s shareholders, lenders and employees. I should have prepared the bank better for the storm that hit it.”

The Telegraph

France ~ David de Rothschild

Arresting Rothschild

Since the 1900′s the vast majority of the American population has dreamed about saying “NO” to the Unconstitutional, corrupt, Rothschild / Rockefeller banking criminals, but no one has dared to do so. Why? If just half of our Nation, and the “1%”, who pay the majority of the taxes, just said NO MORE! Our Gov’t would literally change over night.

Why is it so hard, for some people to understand, that by simply NOT giving your money, to large Corporations, who then send jobs, Intellectual Property, etc. offshore and promote anti-Constitutional rights… You will accomplish more, than if you used violence.

In other words…

“RESEARCH WHERE YOU ARE SENDING EVERY SINGLE PENNY!!! Is that so hard?”

The truth of the matter is… No one, except the Icelanders, have to been the only culture on the planet to carry out this successfully. Not only have they been successful, at overthrowing the corrupt Gov’t, they’ve drafted a Constitution, that will stop this from happening ever again.

That’s not the best part… The best part, is that they have arrested ALL Rothschild/Rockefeller banking puppets, responsible for Iceland’s economic Chaos and meltdown.

Last week 9 people were arrested in London and Reykjavik for their possible responsibility for Iceland’s financial collapse in 2008, a deep crisis which developed into an unprecedented public reaction that is changing the country’s direction.

![Poster[3]](https://rasica.files.wordpress.com/2012/10/poster3.jpg?w=611&h=853)

NULLIFY THE DEBT

It has been a revolution without weapons in Iceland, the country that hosts the world’s oldest democracy (since 930), and whose citizens have managed to effect change by going on demonstrations and banging pots and pans. Why have the rest of the Western countries not even heard about it?

Pressure from Icelandic citizens’ has managed not only to bring down a government, but also begin the drafting of a new constitution (in process) and is seeking to put in jail those bankers responsible for the financial crisis in the country.

As the saying goes, if you ask for things politely it is much easier to get them. This quiet revolutionary process has its origins in 2008 when the Icelandic government decided to nationalise the three largest banks, Landsbanki, Kaupthing and Glitnir, whose clients were mainly British, and North and South American.

After the State took over, the official currency (krona) plummeted and the stock market suspended its activity after a 76% collapse. Iceland was becoming bankrupt and to save the situation, the International Monetary Fund (IMF) injected U.S. $ 2,100 million and the Nordic countries helped with another 2,500 million.

IT WAS DONE IN AMERICA IN 1776

Great Victories By The Sovereign People!

- Last Lap Dance For Rothschild: Iceland’s Viking Victory Over The Matrix Banksters!

- There Has NEVER Been a Bigger Fundamental Reason to Own Physical Gold and Silver Than THIS August 2016

In April a coalition government was elected, formed by the Social Democratic Alliance and the Left Green Movement, headed by a new Prime Minister, Jóhanna Sigurðardóttir.

Throughout 2009 the Icelandic economy continued to be in a precarious situation (at the end of the year the GDP had dropped by 7%) but, despite this, the Parliament proposed to repay the debt to Britain and the Netherlands with a payment of 3,500 million Euros, a sum to be paid every month by Icelandic families for 15 years at 5.5% interest.

The move sparked anger again in the Icelanders, who returned to the streets demanding that, at least, that decision was put to a referendum. Another big small victory for the street protests: in March 2010 that vote was held and an overwhelming 93% of the population refused to repay the debt, at least with those conditions.

This forced the creditors to rethink the deal and improve it, offering 3% interest and payment over 37 years. Not even that was enough. The current president, on seeing that Parliament approved the agreement by a narrow margin, decided last month not to approve it and to call on the Icelandic people to vote in a referendum so that they would have the last word.

Remember

on September 12, 2009 +2,000,000 Americans Marched Upon Washington

& MSNBC said it was only 50,000 at most? Why Was That?

Interpol, meanwhile, had issued an international arrest warrant against Sigurdur Einarsson, former president of one of the banks. This situation led scared bankers and executives to leave the country en masse.

In this context of crisis, an assembly was elected to draft a new constitution that would reflect the lessons learned and replace the current one, inspired by the Danish constitution. To do this, instead of calling experts and politicians, Iceland decided to appeal directly to the people, after all they have sovereign power over the law.

More than 500 Icelanders presented themselves as candidates to participate in this exercise in direct democracy and write a new constitution. 25 of them, without party affiliations, including lawyers, students, journalists, farmers and trade union representatives were elected.

Among other developments, this constitution will call for the protection, like no other, of freedom of information and expression in the so-called Icelandic Modern Media Initiative, in a bill that aims to make the country a safe haven for investigative journalism and freedom of information, where sources, journalists and Internet providers that host news reporting are protected.

The people, for once, will decide the future of the country while bankers and politicians witness the transformation of a nation from the sidelines.

El Reportero

- Bankers’ New Clothes: The Bullet Or The Bribe!

- RollingStone ~ Rothschild Corruption Goes Mainstream

- London [aka;Rothschild] gold-fix banks accused of manipulation in U.S. lawsuit.

- RollingStone ~ Everything Is Rothschild Rigged: The Biggest Price-Fixing Scandal Ever

- RollingStone ~ Obama’s Secrets And Lies Of The Bailouts: Tarp Ceiling Was Secretly Raised 117 Times

- RollingStone ~ The Fed’s aka; Rothschild’s Magic Money-Printing Machine: Usurping U.S. Gold Backed Currency!

- China Escalates Crackdown On Corrupt Banking: 370 People Arrested In Illegal Foreign-Exchanges Totaling $64 Billion.

- RollingStone ~ “Conspiracy Theorists Of The World, Believers In The Hidden Hands Of The Rothschilds, We Skeptics Owe You An Apology.